Use these links to rapidly review the document

Table of ContentsTABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

|

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

NOTICE OF 2019 ANNUAL MEETING

AND

PROXY STATEMENT

Table of Contents

April 12, 2019

Dear Stockholder:

On behalf of the Board of Directors, it is my pleasure to invite you to attend the 20192021 Annual Meeting of Stockholders of Neenah, Inc. to be held on Thursday, May 20, 2021 at the Company's headquarters located at Preston Ridge III, 3460 Preston Ridge Road, Suite 600, Alpharetta, Georgia 30005 on Wednesday, May 22, 2019 at 10:3:00 a.m.p.m., Eastern Daylight Time.Daylight. Due to the ongoing public health impact of the coronavirus pandemic (COVID-19) and to support the health and well-being of our stockholders, employees and their families, the 2021 Annual Meeting will be held virtually via live webcast. Additional information regarding the 2021 Annual Meeting may be found in the attached Proxy Statement.

2018 reflected both anLooking back on 2020 and the unprecedented riseimpact of the COVID-19 pandemic, I am pleased with how Neenah demonstrated its resiliency. We saw how we can be decisive, act quickly and be creative, build new relationships with customers, and leverage our technology in inputnew ways. This is a credit to our employees, whose health and distributionsafety are always our top priority.

We also aggressively managed costs and scale inefficiencies duringworking capital, generating near record cash flow and ending the ramp-upyear with over $175 million of available liquidity. While protecting our world-class U.S. filtration asset,employees and maintaining our strong financial position were top priorities for 2020, our teams worked to address these near-term challenges while continuing to execute on strategicalso accomplished a number of other initiatives that can provide long-term valuewill make us stronger in the years to come.

Some of these included:

- •

- Updating our vision and strategy, providing clear direction and focus for our

stockholders. Revenues surpassed $1 billion for the first time, with volume-driven organic increases in targeted growth categories supplemented by the additionorganization on key drivers that will add significant value and successful integration of Neenah Coldenhove, a company acquired in November 2017 that boosted our presence in the fast-growing digital transfer market. We also expanded our global filtration manufacturing base, qualifying additional grades and customers to support our continued growth in this category,our four targeted platforms

- •

- Implementing a new operating system, employing LEAN principles and methodologies at our two largest plants, helping to drive safety and cost improvements

- •

- Reinvigorating our innovation efforts and launching a number of new products, including the development of high-performance media for face masks, alternatives to plastic signage and packaging, new teacher tools, journals and planners, and environmentally friendly dissolvable labels

- •

- Publishing a Corporate Sustainability Report, highlighting the meaningful progress made over the past five years in reducing our carbon footprint, building a more diverse and inclusive workplace, and maintaining sound governance practices

- •

- Maintaining a disciplined and active M&A pipeline, leading to the April 2021 acquisition of ITASA, a leading global specialty coatings company

With these actions, we continued on December 31, 2018, divested a non-strategic operating facility in Brattleboro, Vermont to improve operational efficiencies in our Fine Paper & Packaging business.

We remain committed to deploying our strong cash flows towards opportunities that generate the best returns while maintaining our focus on Return on Invested Capital, a strong balance sheet, and returning a portion of our cash flows to stockholders through an attractive dividend. In November 2018, our Board authorized a 10 percent increase in our dividend, marking a ninth consecutive double-digit increase.

We appreciate the contributions of Neenah's dedicated employees around the world and the confidence and support of our customers and stockholders as we continuepath to become a leading global specialty materials company known for its ability to create sustainable value for stakeholders, its stockholders, a commitmentdedication to providing a safe and healthy workplace for its employees, and as a responsible and engaged steward of the environment and communities in which we operate. Finally, I'd like to recognize the service of our two Board members, Sean Erwin and Jack McGovern, who will not be running for re-election in 2019. Sean's leadership as CEO during the early years of Neenah's transformation was critical to putting us on the successful path we're on today.

The formal business to be transacted at the 20192021 Annual Meeting includes:

- •

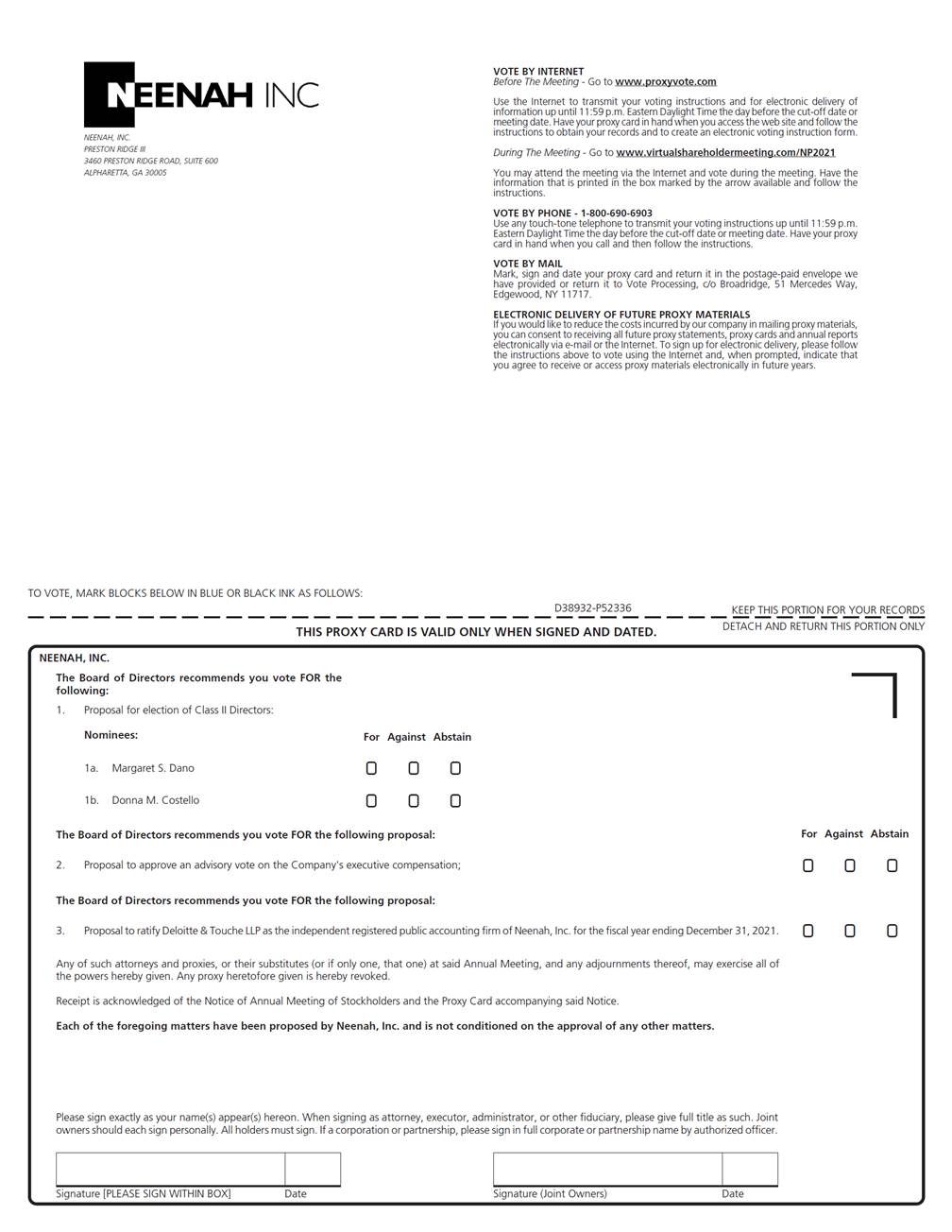

The electionElection of the two nominees detailed in this Proxy Statement as Class IIIII directors for a three-year term;

- •

- Approval of an advisory vote on the Company's executive compensation; and

- •

The ratificationRatification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2019.2021.

At the meeting, we will provide a brief report on our results and strategies. Our directors and executive officers, as well as representatives from Deloitte & Touche LLP, will be in attendance to answer any questions you may have.

Table of Contents

questions. Regardless of whether you choose to attendparticipate or not, please either vote electronically, by telephone, or follow the procedures for requesting written copies of the proxy materials described in the attached Proxy Statement and mark, date, sign and return the proxy card included with those materials at your earliest convenience. This will assure your shares will be represented and voted at the 2021 Annual Meeting.

I have seen a lot in my first year as Chief Executive Officer at Neenah—how talented and passionate our employees are, how creative and responsive they can be, the deep and strong relationships we have with our customers, and the support we have from our shareholders. Looking ahead, I couldn't be more excited. With Neenah's talented leadership team and outstanding employees, our strong financial position, catalysts in place to drive value, and clear strategies to enable future growth, I look forward to updating you on our progress in the years ahead.

I'd also like to thank our Board of Directors for their continued direction and support and recognize Steve Wood, who will be stepping down this year after more than 15 years of outstanding service. On behalf of our Board of Directors, thank you for your support and trust.

| | |

| | | Sincerely, |

|

|

|

|

| Julie A. Schertell

JOHN P. O'DONNELL

President and Chief Executive Officer |

Table of Contents

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS |

| | | | | | |

| | Meeting Date:

May 20, 2021 | |  | | Meeting Time:

3:00pm (Eastern Daylight Time) |

|

|

Meeting Place:

www.virtualshareholdermeeting.com/NP2021 |

|

|

|

Record Date:

March 26, 2021 |

Preston Ridge III

3460 Preston Ridge Road, Suite 600

Alpharetta, Georgia 30005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 22, 2019

NOTICE HEREBY IS GIVENMatters that the 2019 Annual Meeting of Stockholders of Neenah, Inc. will be held at the Company's headquarters located at Preston Ridge III, 3460 Preston Ridge Road, Suite 600, Alpharetta, Georgia 30005 on Wednesday, May 22, 2019 at 10:00 a.m., Eastern Daylight Time, for the purpose of considering and votingvoted upon:

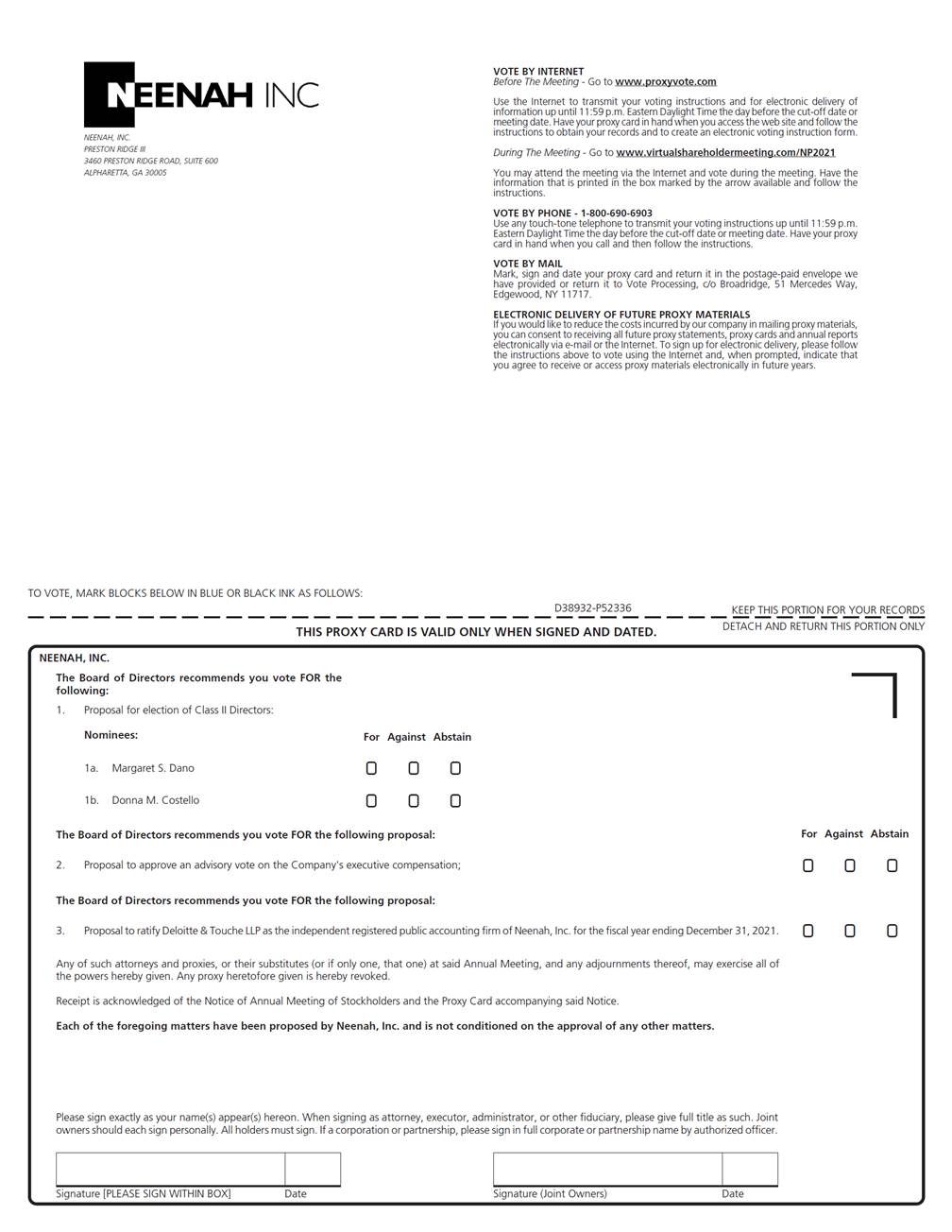

- 1.

- A proposal to elect the two nominees named as Class

IIIII directors in the attached Proxy Statement to serve until the 20222024 Annual Meeting of Stockholders;

- 2.

- A proposal to approve, on an advisory basis, the Company's executive compensation;

- 3.

- A proposal to ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of Neenah, Inc. for the fiscal year ending December 31,

2019;2021; and

- 4.

- Such other business as properly may come before the Annual Meeting or any adjournments thereof. The Board of Directors is not aware of any other business to be presented to a vote of the stockholders at the Annual Meeting.

NOTICE HEREBY IS GIVEN that the 2021 Annual Meeting of Stockholders of Neenah, Inc. will be held virtually via live webcast on Thursday, May 20, 2021 at 3:00 p.m., Eastern Daylight. Information relating to the above matters is set forth in the attached Proxy Statement. Stockholders of record at the close of business on March 29, 201926, 2021 are entitled to receive notice of and to vote atduring the Annual Meetinglive webcast and any adjournments thereof. Stockholders can attend the virtual meeting by visiting www.virtualshareholdermeeting.com/NP2021 and using the 16-digit control number found on their proxy card. Stockholders will be able to vote their shares electronically and submit questions during the meeting. Whether or not you plan to attend the virtual meeting, all stockholders are encouraged to vote in advance by using one of the methods described in the attached Proxy Statement.

This Proxy Statement and the 20182020 Annual Report to Stockholders are available at www.neenah.com/proxydocs.on our Investor Relations webpage at: www.neenah.com.

| | |

| | By order of the Board of Directors. |

|

|

|

|

|

NOAH S. BENZ

Senior Vice President, General Counsel and Secretary |

By order of the Board of Directors.

Noah S. Benz

Executive Vice President, General Counsel and Secretary

Alpharetta, Georgia

April 12, 20199, 2021

PLEASE READ THE ATTACHED PROXY STATEMENT AND THEN VOTE ELECTRONICALLY, BY TELEPHONE, OR REQUEST PRINTED PROXY MATERIALS AND PROMPTLY COMPLETE, EXECUTE, AND RETURN THE PROXY CARD INCLUDED WITH THE PROXY MATERIALS IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE.

Neenah, Inc. 2021 Proxy Statement | 1

Table of Contents

Table of Contents

| | | | |

PROXY STATEMENT SUMMARY | | | 3 | |

CORPORATE GOVERNANCE AND BOARD MATTERS | | |

| |

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTINGBoard of Directors

| | |

4 |

BENEFICIAL OWNERSHIP

| |

7 |

ELECTION OF DIRECTORS (ITEM 1)Director Skills Summary

| | |

119 | |

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORSMeetings and Committees of The Board of Directors

| | |

1510 | |

CORPORATE GOVERNANCECorporate Governance

| | |

1712 | |

2018 DIRECTOR COMPENSATION2020 Director Compensation

| | |

2116 | |

EXECUTIVE COMPENSATION | | |

23 | |

COMPENSATION COMMITTEE REPORTCompensation Discussion and Analysis

| | |

3718 | |

ADVISORY VOTE ON EXECUTIVE COMPENSATION (ITEMCompensation Committee Report

| | |

32 | |

Additional Executive Compensation Information | | |

33 | |

AUDIT RELATED MATTERS | | |

| |

Audit Committee Report | | |

43 | |

Independent Registered Public Accounting Firm Fees and Services | | |

43 | |

Policy on Audit Committee Pre-approval | | |

43 | |

ITEMS TO BE VOTED UPON | | |

| |

Election of Directors (Item 1) | | |

44 | |

Advisory Vote on Executive Compensation (Item 2) | | |

3845 | |

ADDITIONAL EXECUTIVE COMPENSATIONRatification of Appointment of Independent Registered Public Accounting Firm (Item 3)

| | |

46 | |

OTHER INFORMATION | | |

40 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATIONFAQ: Annual Meeting and Voting

| | |

47 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

| |

47 |

AUDIT COMMITTEE REPORTBeneficial Ownership

| |

48 |

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (ITEM 3)

| |

49 |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND SERVICES

| |

49 |

STOCKHOLDERS' PROPOSALS FOR 2020 ANNUAL MEETINGStockholders' Proposals for 2022 Annual Meeting

| | |

5052 | |

OTHER MATTERS THAT MAY COME BEFORE THE ANNUAL MEETINGHouseholding of Notice of Internet Availability of Proxy Materials

| | |

5052 | |

HOUSEHOLDING OF NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALSSection 16(a) Beneficial Ownership Reporting Compliance

| | |

5153 | |

Neenah, Inc. 2021 Proxy Statement | 2

Table of Contents

PROXY STATEMENT

General Information

Our Board of Directors is soliciting proxies from our stockholders in connection with Neenah's Annual Meeting of Stockholders. When used in this Proxy Statement, the terms "we," "us," "our," "the Company," and "Neenah" refer to Neenah, Inc. and its consolidated subsidiaries. The approximate date on which this Proxy Statement is being filed and notice is being sent or given to stockholders of record is April 12, 2019.9, 2021.

Effective January 1, 2018, Neenah Paper, Inc. changed its name to Neenah, Inc. The Company's ticker symbol on the New York Stock Exchange remains "NP" and the names of subsidiaries were not affected.

SUMMARY

This summary highlights information contained in the Proxy Statement. It does not include all of the information that you should consider prior to voting and we encourage you to read the entire document prior to voting.

For more complete information regarding Neenah's 2018 financial performance, please review the Company's Annual Report on Form 10-K for the year ended December 31, 2018.2020.

Stockholders are being asked to vote on the following matters at the 2019 Annual Meeting of Stockholders:STOCKHOLDERS ARE BEING ASKED TO VOTE ON THE FOLLOWING

MATTERS AT THE 2021 ANNUAL MEETING:

| | |

| | Our Board's Recommendation | | | | | | | | | | | | Description | | Item | | Board Recommendation | | Page |

|

|

Election of DirectorsThe Board and the Nominating and Corporate Governance Committee believe that the two Class II Director nominees possess the necessary qualifications, attributes, skills and experiences to provide quality advice and counsel to the Company's management and effectively oversee the business and the long-term interests of stockholders. |

|

1 |

|

FOR Each

Director Nominee |

|

44 | | | | | | | | | | | | | | | | | | | | |

|

|

Advisory Vote to Approve Executive CompensationThe Company seeks a non-binding advisory vote to approve the compensation of its named executive officers as described in the Compensation Discussion and Analysis section beginning on page 18 and the Executive Compensation Tables section beginning on page 33. The Board values stockholders' opinions, and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. |

|

2 |

|

FOR |

|

45 | | | | | | | | | | | | | | | | | | | | |

|

|

Ratification of the Appointment of Deloitte & Touche, LLP, as Independent AuditorsThe Audit Committee and the Board believe that the retention of Deloitte & Touche, LLP, to serve as the Independent Auditors for the fiscal year ending December 31, 2021 is in the best interest of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee's selection of the Independent Auditors. |

|

3 |

|

FOR |

|

46 |

|

|---|

ITEM 1. Election of Directors (page 11) | | |

The Board and the Nominating and Corporate Governance Committee believe that the two Class III Director nominees possess the necessary qualifications, attributes, skills and experiences to provide quality advice and counsel to the Company's management and effectively oversee the business and the long-term interests of stockholders. | | FOR each

Director Nominee |

ITEM 2. Advisory Vote to Approve Executive Compensation (page 38) | | |

The Company seeks a non-binding advisory vote to approve the compensation of its named executive officers as described in the Compensation Discussion and Analysis section beginning on page 23 and the Executive Compensation Tables section beginning on page 40. The Board values stockholders' opinions, and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. | | FOR |

ITEM 3. Ratification of the Appointment of Deloitte & Touche, LLP, as Independent Auditors (page 49) | | |

The Audit Committee and the Board believe that the retention of Deloitte & Touche, LLP, to serve as the Independent Auditors for the fiscal year ending December 31, 2019 is in the best interest of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee's selection of the Independent Auditors. | | FOR |

Table of Contents

Questions and Answers about the Annual Meeting and Voting

When and where is the Annual Meeting?

| | |

When: | | Wednesday, May 22, 2019, at 10:00 A.M. Eastern Daylight Time |

Where: |

|

Company headquarters located at Preston Ridge III, 3460 Preston Ridge Road, Suite 600, Alpharetta, Georgia 30005 |

Who is entitled to vote at the Annual Meeting?

You are entitled to vote at the Annual Meeting if you owned our common stock, par value $0.01 per share, as of the close of business March 29, 2019 (the "Record Date"), with each share entitling its owner to one vote on each matter submitted to the stockholders. On the record date, 16,865,544 shares of common stock were outstanding and eligible to be voted at the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the issued and outstanding shares of our common stock is necessary to constitute a quorum at the 2019 Annual Meeting.

How do I vote at the Annual Meeting?

You may vote in person at the Annual Meeting or by proxy. We recommend you vote by proxy even if you plan to attend the 2019 Annual Meeting. You can always change your vote at the meeting. Giving us your proxy means you authorize us to vote your shares at the 2019 Annual Meeting in the manner you direct. If you plan to attend the meeting in person you must provide proof of your ownership of our common stock as of the Record Date, such as an account statement, and a form of personal identification for admission to the meeting. If you hold your shares in street name and you also wish to be able to vote at the 2019 Annual Meeting, you are required to obtain a proxy from your bank or broker, executed in your favor.

If your shares are held in your name, you can vote by proxy in three convenient ways:

•Via the Internet:Neenah, Inc. Go tohttp://www.proxyvote.com and follow the instructions.

•By Telephone: Call toll-free 1-800-690-6903 and follow the instructions.

•By Mail: Request a printed copy of the proxy materials disclosed in this2021 Proxy Statement and complete, sign, date and return your proxy card in the envelope included with your printed proxy materials.

If your shares are held in street name, the availability of telephone and internet voting will depend on the voting processes of the applicable bank or brokerage firm; therefore, it is recommended that you follow the voting instructions on the form you receive from your bank or brokerage firm. All properly executed proxies received by the Company in time to be voted at the 2019 Annual Meeting and not revoked will be voted at the 2019 Annual Meeting in accordance with the directions noted on the proxy card. If any other matters properly come before the 2019 Annual Meeting, the persons named as proxies will vote upon such matters according to their judgment.

We are also sending the Notice and voting materials to participants in various employee benefit plans of the Company. The trustee of each plan, as the stockholder of record of the shares of common stock held in the plan, will vote whole shares of stock attributable to each participant's interest in the plan in accordance with the directions the participant gives or, if no directions are given by the participant, in accordance with the directions received from the applicable plan committees.

Can I change my vote?

Any stockholder of record delivering a proxy has the power to revoke it at any time before it is voted at the 2019 Annual Meeting: (i) by giving written notice to Noah S. Benz, Senior Vice President, General Counsel and Secretary at Preston Ridge III, 3460 Preston Ridge Road, Suite 600, Alpharetta,

Table of Contents

Georgia 30005; (ii) by submitting a proxy card bearing a later date, including a proxy submitted via the Internet or by telephone; or (iii) by voting in person at the 2019 Annual Meeting. Please note, however, that any beneficial owner of our common stock whose shares are held in street name may (a) revoke his or her proxy and (b) attend and vote his or her shares in person at the 2019 Annual Meeting only in accordance with applicable rules and procedures as then may be employed by such beneficial owner's brokerage firm or bank.

What Proposals am I being asked to vote on at the 2019 Annual Meeting and what is required to approve each proposal?

You are being asked to vote on three proposals: Proposal 1 the election of the two nominees as Class III directors; Proposal 2 the approval, in a non-binding advisory vote, of Neenah's executive compensation; and Proposal 3 the ratification of the appointment of our independent public accounting firm.

In voting with regard to Proposal 1, you may vote in favor of each nominee, against each nominee, or may abstain from voting. A majority of the shares of common stock represented and entitled to vote on Proposal 1 is required for the election of each director, provided a quorum is present. Abstentions will be considered in determining the number of votes required to obtain the necessary majority vote for the proposal, and therefore will have the same legal effect as votes against the proposal.

In voting with regard to Proposals 2 and 3, you may vote in favor of each proposal, against each proposal, or may abstain from voting. The vote required to approve Proposals 2 and 3 is majority of the shares of common stock represented and entitled to vote, provided a quorum is present. Abstentions will be considered in determining the number of votes required to obtain the necessary majority vote for each proposal, and therefore will have the same legal effect as votes against such proposal.

Neenah is not aware, as of the date hereof, of any matters to be voted upon at the 2019 Annual Meeting other than those stated in this Proxy Statement. If any other matters are properly brought before the 2019 Annual Meeting, your proxy gives discretionary authority to the persons named as proxies to vote the shares represented thereby in their discretion.

What happens if I don't return my proxy card or vote my shares?

If you hold your shares directly your shares will not be voted if you do not return your proxy card or vote in person at the 2019 Annual Meeting.

If your shares are held in the name of a bank or brokerage firm (in "street name") and you do not vote your shares, your bank or brokerage firm will only be permitted to exercise discretionary authority to vote your shares for proposals which are considered "discretionary" proposals. We believe that Proposal 3 is a discretionary proposal.

Brokers are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions to the broker for proposals which are considered "non-discretionary" (a "broker non-vote"). We believe Proposals 1 and 2 are non-discretionary proposals. As such, broker non-votes will be counted for the purpose of determining if a quorum is present, but will not be considered as shares entitled to vote on Proposals 1 and 2, and therefore will have no effect on the outcome of these proposals.

What happens if I sign, date and return my proxy card but do not specify how to vote my shares?

If a signed proxy card is received which does not specify a vote or an abstention, then the shares represented by that proxy card will be votedFOR| the election of all Class III director nominees described herein,FOR the approval of the Company's executive compensation, andFOR the3

Table of Contents

ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2019.

Why haven't I received a printed copy of the Proxy Statement or annual report?

We are choosing to follow the Securities and Exchange Commission ("SEC") rules that allow companies to furnish proxy materials to stockholders via the Internet. If you received a Notice of Internet Availability of Proxy Materials, or "Notice," by mail, you will not receive a printed copy of the proxy materials, unless you specifically request one. The Notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report as well as how to submit your proxy over the Internet. If you received the Notice and would still like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials included in the Notice. We plan to mail the Notice to stockholders by April 12, 2019.

Who pays for the cost of this proxy solicitation?

We will bear the cost of preparing, printing and filing the Proxy Statement and related proxy materials. In addition to soliciting proxies through the mail, we may solicit proxies through our directors, officers, and employees, in person and by telephone or email and facsimile. We expect to retain Okapi Partners LLC to aid in the solicitation at a cost of approximately $9,000, plus reimbursement of out-of-pocket expenses. Brokerage firms, nominees, custodians, and fiduciaries also may be requested to forward proxy materials to the beneficial owners of shares held of record by them. We will pay all expenses incurred in connection with the solicitation of proxies.

When will voting results be made available?

We will announce the final results on our website athttp://www.neenah.com shortly after the 2019 Annual Meeting and on Form 8-K immediately following the meeting.

Table of Contents

CLASS II DIRECTORSBENEFICIAL OWNERSHIP – NOMINATED FOR RE-ELECTION:

| | | | |

|

|

Margaret S. DanoMargaret S. Dano is the former Chairman of the Board for Superior Industries International, Inc., a leading manufacturer of aluminum road wheels for use in the automobile and light truck industry. Ms. Dano was appointed as Chairman of the Board in 2014 and served as a director for Superior from 2007 to 2017. In addition, Ms. Dano currently serves as a director of Douglas Dynamics, Inc., a manufacturer of snow and ice control equipment for the global light truck market, a position she has held since 2012, where she chairs the Governance Committee and serves on both the Compensation and Audit Committees. From 2002 to 2005, Ms. Dano served as Vice President, Worldwide Integrated Supply Chain and Operations for Honeywell Corporation. Prior to that, she served as Vice President, Worldwide Supply Chain Office Products & GM Printer Papers for Avery Dennison Corporation from 1999 to 2002 and Vice President of Corporate Manufacturing & Engineering from 1996 to 1999. Ms. Dano received a BS in mechanical engineering from Kettering University (formerly the General Motors Institute). Ms. Dano has served as a director of Neenah since 2015. Ms. Dano's senior executive experience in global manufacturing and supply chain and her public board experience and leadership with manufacturing companies make her an effective member of Neenah's Board. |

|

Age

61

Race/Ethnicity

White/Non-Hispanic Director Since

2015 Committees

Nominating and Corporate Governance Committee Compensation Committee Public Directorship Experience

Superior Industries International, Inc.

Douglas Dynamics, Inc. Independent

Yes |

| | | | | |

|

|

Donna M. CostelloDonna M. Costello was the Chief Financial Officer of C&D Technologies from 2016 until early 2020. Previously, Ms. Costello served as Chief Financial Officer of Sequa Corporation, a $1.5 billion global manufacturer and service provider in the Industrial and Aerospace markets, from 2008 to 2015. Prior to being promoted to Chief Financial Officer in 2008, Ms. Costello served as Vice President and Controller of Sequa Corporation, which was a publicly traded company until its acquisition by The Carlyle Group in 2007. From 2002 to 2005, Ms. Costello served as Vice President and Controller of Chromalloy Gas Turbine, Sequa's largest subsidiary. Ms. Costello began her career in 1995 as an auditor for Arthur Andersen and advanced through a series of assignments to become a senior audit manager in 1999. Ms. Costello currently serves as a director of CTS Corporation, a manufacturer of sensors, actuators, and electronic components for the aerospace/defense, industrial, medical, telecommunications/IT, and transportation markets, a position she has held since 2021, where she serves on both the Compensation and Audit Committees. Ms. Costello received her BBA and MBA from Iona College. Ms. Costello is a certified public accountant and a member of both the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants. Ms. Costello is also a member of the Henry Crown Fellowship Program of the Aspen Institute. Ms. Costello has served as a director of Neenah since 2019. |

|

Age

48

Race/Ethnicity

White/Non-Hispanic Director Since

2019 Committees

Audit Committee Public Directorship Experience

CTS Corporation Independent

Yes |

DIRECTORS AND EXECUTIVE OFFICERSNeenah, Inc.

The following table sets forth information regarding the beneficial ownership of our common stock as of March 29, 2019 with respect to: (i) each of our directors; (ii) each of the named executive officers appearing elsewhere herein; and (iii) all executive officers and directors as a group, based in each case on information furnished to us by such persons. As used in this 2021 Proxy Statement "beneficial ownership" means that a person has, as of March 29, 2019, or may have within 60 days thereafter, the sole or shared power to vote or direct the voting of a security and/or the sole or shared investment power to dispose of or direct the disposition of a security.| 4

| | | | | | | |

Name | | Shares

Beneficially

Owned(1) | | Percent of

Class(2) | |

|---|

William M. Cook | | | 4,089 | (3) | | * | |

Margaret S. Dano | | | 2,498 | (4) | | * | |

Matthew L. Duncan | | | 315 | (5) | | * | |

Sean T. Erwin | | | 19,771 | (6) | | * | |

Bonnie C. Lind | | | 30,402 | (7) | | * | |

Timothy S. Lucas | | | 16,901 | (8) | | * | |

John F. McGovern | | | 1,208 | (9) | | * | |

Philip C. Moore | | | 20,228 | (10) | | * | |

John P. O'Donnell | | | 97,968 | (11) | | * | |

Byron J. Racki | | | 4,804 | (12) | | * | |

Julie A. Schertell | | | 7,150 | (13) | | * | |

Tony R. Thene | | | 0 | (14) | | * | |

Stephen M. Wood | | | 36,113 | (15) | | * | |

| | | | | | | |

All directors and executive officers as a group (16 persons) | | | 272,104 | (16) | | 1.6 | |

(1)Except as otherwise noted, the directors and executive officers, and all directors and executive officers as a group, have sole voting power and sole investment power over the shares listed. Shares of common stock held by the trustee of Neenah's 401(k) Retirement Plan for the benefit of, and which are attributable to our executive officers, are included in the table.

(2)An asterisk indicates that the percentage of common stock beneficially owned by the named individual does not exceed 1% of the total outstanding shares of our common stock.

(3)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019.

(4)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019.

(5)This total does not include 2,429 vested Stock Appreciation Rights.

(6)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019. Mr. Erwin is not standing for re-election as a Class III director at the 2019 Annual Meeting

(7)This total does not include 18,392 vested Stock Appreciation Rights.

(8)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019. This total does not include 3,310 vested Stock Appreciation Rights.

Table of Contents

(9)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019. Mr. McGovern is not standing for re-election as a Class

CLASS III director at the 2019 Annual Meeting.DIRECTORS – TERM EXPIRING AT THE 2022 ANNUAL MEETING:

(10)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019.

(11)This total does not include 63,857 vested Stock Appreciation Rights.

(12)This total does not include 7,879 vested Stock Appreciation Rights.

(13)This total does not include 29,763 vested Stock Appreciation Rights.

(14)Mr. Thene was appointed to the Board of Directors on February 1, 2019.

(15)Includes 1,208 shares of common stock issuable upon conversion of restricted stock units that are vested or will vest within 60 days of March 29, 2019.

(16)On July 1, 2014 the Company converted all outstanding Stock Options to Stock Appreciation Rights which are not included in the calculation of beneficial ownership. Stock Appreciation Rights are disclosed in detail under the "Outstanding Equity Awards at 2018 Fiscal Year-End" section of this

| | | | |

|

|

Timothy S. LucasTimothy S. Lucas was an independent financial reporting consultant with Lucas Financial Reporting from 2002 until retiring in December 2017. From 1988 to 2002, Mr. Lucas worked at the Financial Accounting Standards Board ("FASB"), where he was the Director of Research and Technical Activities, and Chairman of the FASB's Emerging Issues Task Force. Mr. Lucas has served as a director of Neenah since 2004. Mr. Lucas received his BA in Economics and BS in Accounting from Rice University and his Master of Accounting from the Jesse H. Jones Graduate School, Rice University. Mr. Lucas' experience at FASB, consulting experience, and educational background make him an effective member of Neenah's Board. |

|

Age

74

Race/Ethnicity

White/Non-Hispanic Director Since

2004 Committees

Audit Committee Compensation Committee Public Directorship Experience

N/A Independent

Yes |

| | | | | |

|

|

Tony R. TheneTony R. Thene currently serves as director and Chief Executive Officer of Carpenter Technology Corporation, a leader in specialty alloy based materials and process solutions. Mr. Thene began his career at Carpenter in 2013 as Chief Financial Officer and has served as a director since 2015. Prior to joining Carpenter, Mr. Thene served as Chief Financial Officer of the Engineered Products and Solutions Business Group at Alcoa, Inc. from 2010 until 2013. Previously, he served as Vice President, Controller and Chief Accounting Officer of Alcoa. He also previously held various other positions during his 23-year career at Alcoa, including Director, Investor Relations; Chief Financial Officer for the Flat Rolled Products Group; Chief Financial Officer for Alcoa World Alumina and Chemicals; and manufacturing manager for the Alumina Chemicals business. Mr. Thene received his BS in Accounting from Indiana State University and his MBA from the Weatherhead School of Management at Case Western Reserve University. Mr. Thene has served as a director of Neenah since 2019. Mr. Thene's educational background, financial expertise, and extensive experience in the specialty materials industry make him an effective member of Neenah's Board. |

|

Age

60

Race/Ethnicity

White/Non-Hispanic Director Since

2019 Committees

Nominating and Corporate Governance Committee Compensation Committee Public Directorship Experience

Carpenter Technology Corporation Independent

Yes |

Neenah, Inc. 2021 Proxy Statement.

Statement | 5

Table of Contents

The following table sets forth information regarding the beneficial ownership of our common stock as of December 31, 2018 for each person known to us to be the beneficial owner of more than 5% of our outstanding common stock.CLASS I DIRECTORS – TERM EXPIRING AT THE 2023 ANNUAL MEETING:

| | | | | | | |

| | Common Stock Beneficially Owned | |

|---|

Name and Address of Beneficial Owner | | Number of Shares | | Percent of Class | |

|---|

Blackrock, Inc. | | | 2,443,162 | (1) | | 14.5 | % |

55 East 52nd Street

New York, NY 10055 | | | | | | | |

Wells Fargo & Company | | |

1,165,368 |

(2) | |

6.91 |

% |

420 Montgomery St.

San Francisco, CA 94163 | | | | | | | |

The Vanguard Group | | |

1,046,101 |

(3) | |

6.20 |

% |

100 Vanguard Blvd.

Malverne, PA 19355 | | | | | | | |

Wellington Management Group LLP | | |

999,699 |

(4) | |

5.93 |

% |

280 Congress Street

Boston, MA 02210 | | | | | | | |

Macquarie Investment Management Holdings, Inc | | |

924,005 |

(5) | |

5.48 |

% |

2005 Market Street

Philadelphia, PA 19103(6) | | | | | | | |

(1)The amount shown and the following information is derived from the Schedule 13G filed by Blackrock, | | | | |

|

|

William M. CookWilliam M. Cook is the retired Executive Chairman (2015-2016) of Donaldson Company Inc., a technology-driven global company that manufacturers filtration systems to remove contaminants from air and liquids. Mr. Cook is also the former Chairman (2005-2015), President and Chief Executive Officer (2004-2015) of Donaldson. Prior to that, Mr. Cook held various roles at Donaldson of increasing responsibility, including service as Senior Vice President, International (2000-2004); Chief Financial Officer (2001-2004); and Senior Vice President, Commercial and Industrial (1994-2000). Mr. Cook is also currently a Director of IDEX Corporation (where he serves as Lead Director and also on the Audit Committee) and was a director of Valspar Corporation (where he served on the Audit Committee) from 2010 to 2017. Mr. Cook brings to the Neenah Board his filtration industry and operations experience and financial expertise for the past 35 years at Donaldson where he held a wide range of financial and business positions with global responsibilities. Mr. Cook is an experienced public company Board member having served on the Donaldson Board from 2004-2016 and as an independent director for IDEX and Valspar. Mr. Cook also has valuable Board experience from his past service to various private and charitable organizations. Mr. Cook has served as a director of Neenah since 2016. Mr. Cook holds a BS degree in Business Management and an MBA degree from Virginia Tech. Mr. Cook's educational background, financial expertise, and extensive experience in the filtration industry make him an effective member of Neenah's Board. |

|

Age

67

Race/Ethnicity

White/Non-Hispanic Director Since

2016 Committees

Audit Committee Public Directorship Experience

Donaldson Company Inc. IDEX Corporation

Valspar Corporation Independent

Yes |

Neenah, Inc. on January 31, 2019, reporting beneficial ownership as of December 31, 2018. Of the 2,443,162 shares reported, Blackrock, Inc. reported sole dispositive power over all 2,443,162 shares and sole voting power over 2,404,536 shares.

(2)The amount shown and the following information is derived from the Schedule 13G filed by Wells Fargo & Company, on behalf of itself and certain subsidiaries named therein, on January 22, 2019, reporting beneficial ownership as of December 31, 2018. Of the 1,165,368 shares reported by Wells Fargo & Company, the filing reported Wells Fargo & Company has sole dispositive power over 17,617 of the shares, shared voting power with respect to 876,655 shares, shared dispositive power with respect to 1,147,751 shares, and sole voting power over 17,617 shares. Of the 1,095,572 shares reported by Wells Capital Management Incorporated, the filing reported Wells Capital Management Incorporated has no voting power with respect to any of the shares and has shared dispositive power with respect to all 1,095,572 shares.

(3)The amount shown and the following information is derived from the Schedule 13G filed by The Vanguard Group on February 11, 2019, reporting beneficial ownership as of December 31, 2018. Of the 1,046,101 shares reported, The Vanguard Group reported sole dispositive power over 1,012,694 of the shares, shared voting power with respect to 3,500 shares, shared dispositive power with respect to 33,407 shares, and sole voting power over 31,322 shares.

(4)The amount shown and the following information is derived from the Schedule 13G filed by Wellington Management Group LLP, on behalf of itself and certain subsidiaries named therein, on February 12, 2019, reporting beneficial ownership as of December 31, 2018. Of the 999,699 shares reported by Wellington Management Group LLP, the filing reported Wellington Management

2021 Proxy Statement | 6

Table of Contents

| | | | |

|

|

Philip C. MoorePhilip C. Moore retired as Senior Vice President, Deputy General Counsel and Corporate Secretary of TD Bank Group, Toronto, Canada on December 31, 2016. Mr. Moore joined TD Bank Group in May 2013, prior to which he had been a partner at McCarthy Tétrault LLP, Canada's national law firm where he practiced corporate and securities law in Toronto and Sydney, Australia, with particular emphasis on corporate governance, finance, mergers and acquisitions, and other business law issues. He has been involved in many corporate mergers, acquisitions, dispositions, and reorganizations, as well as capital markets transactions in a variety of industries and geographies. Mr. Moore has extensive experience in corporate transactions involving the pulp and paper industries. Mr. Moore has been awarded the designation "Chartered Director" from the Directors College, Canada's leading director education program run by McMaster University and the Conference Board of Canada. He has advised on the design and implementation of numerous executive compensation plans, as well as on executive compensation governance matters. From 1994 until 2000, he was a director of Imax Corporation and is currently a director of a number of private corporations. Mr. Moore has served as a director of Neenah since 2004. Mr. Moore received his BA from McMaster University and his LLB from Queen's University. Mr. Moore's educational background and extensive experience in corporate governance and business law make him an effective member of Neenah's Board. |

|

Age

67

Race/Ethnicity

White/Non-Hispanic Director Since

2004 Committees

Audit Committee

Nominating and Corporate Governance Committee Public Directorship Experience

Imax Corporation Independent

Yes |

| | | | | |

|

|

Julie A. SchertellJulie A. Schertell is President and Chief Executive Officer of the Company. Ms. Schertell has been in this role since May 2020. Prior to this, Ms. Schertell was Chief Operating Officer from January 2020 to May 2020, President of Technical Products from September 2018 to December 2019, and President of Fine Paper & Packaging from January 2011 to September 2018. Ms. Schertell joined the Company in 2008 and served as Vice President of Sales and Marketing for the Fine Paper division through December 2010. Ms. Schertell was employed by Georgia-Pacific Corporation in the Consumer Products Retail division, where she served as Vice President of Sales Strategy from 2007 to 2008, and as Vice President of Customer Solutions from 2003 through 2007. Ms. Schertell has served as a director of Neenah since February 2020. Ms. Schertell's extensive experience in the paper and consumer products industries, and leadership positions in the Company make her an effective member of Neenah's Board. |

|

Age

51

Race/Ethnicity

White/Non-Hispanic Director Since

2020 Committees

N/A Public Directorship Experience

N/A Independent

No |

Group LLP has shared voting power with respect to 785,403 shares and shared dispositive power with respect to all 999,699 shares. Of the 999,699 shares shown reported by Wellington Group Holdings LLP, the filing reported Wellington Group Holdings LLP has shared voting power with respect to 785,403 shares and shared dispositive power with respect to allNeenah, Inc. 2021 Proxy Statement | 7

Table of the shares. Of the 999,699 shares shown reported by Wellington Investment Advisors Holdings LLP, the filing reported Wellington Investment Advisors Holdings LLP has shared voting power with respect to 785,403 shares and shared dispositive power with respect to all 999,699 shares. Of the 993,449 shares reported by Wellington Management Company LLP, the filing reported Wellington Management Company LLP has shared voting power with respect to 779,153 shares and shared dispositive power with respect to all 993,449 shares.Contents

(5)The amount shown and the following information is derived from the Schedule 13G filed by Macquarie Investment Management Holdings, Inc., on behalf of itself and certain subsidiaries named therein, on February 14, 2019, reporting beneficial ownership as of December 31, 2018. The filing reported 924,005 shares are deemed beneficially owned by Macquarie Group Limited and Macquarie Bank Limited as a result of these companies' direct or indirect ownership of Macquarie Bank Limited, Macquarie Investment Management Holdings Inc., and Macquarie Investment Management Business Trust. The filing reported neither Macquarie Group Limited nor Macquarie Bank Limited have any voting or dispositive power, either sole or shared, with respect to any of the 924,005 shares. Of the 924,005 shares reported by Macquarie Investment Management Holdings, Inc., and Macquarie Investment Management Business Trust, the filing reported Macquarie Investment Management Holdings, Inc., and Macquarie Investment Management Business Trust have sole dispositive power over 921,718 of the shares and sole voting power over 921,718 shares.

(6)The principal business address of Macquarie Group Limited and Macquarie Bank Limited was reported as 50 Martin Place Sydney, New South Wales, Australia. The principal business address of Macquarie Investment Management Holdings Inc., and Macquarie Investment Management Business Trust was reported as 2005 Market Street, Philadelphia, PA 19103.

DIRECTORS RETIRING EFFECTIVE AS OF THE 2021 ANNUAL MEETING:

| | | | |

|

|

Stephen M. Wood, Ph.D.Stephen M. Wood, Ph.D. is an Operating Partner with Snow Phipps Group LLC, an internationally diversified investment company. Prior to this he served as Chairman of the Board for FiberVisions Corporation which is a leading global manufacturer of synthetic fibers for consumer products, construction, and industrial applications. Dr. Wood was President and Chief Executive Officer of FiberVisions from 2006 to 2012. Dr. Wood was also Chairman of the Board of ESFV, a global joint Venture with JNC Corporation, a leading Japanese Chemical Company. From 2001 to 2004, Dr. Wood served as President and Chief Executive Officer of Kraton Polymers, a specialties chemical company, and Chairman and Representative Director of JSR Kraton Elastomers, a Japanese joint venture company. Prior to this Dr. Wood was President of the Global Elastomers business of Shell Chemicals, Ltd., and a Vice President of that company. Dr. Wood was also elected International President of the International Institute of Synthetic Rubber Producers. Dr. Wood has a BSc in Chemistry and a Ph.D. in Chemical Engineering from Nottingham University, United Kingdom and is a graduate of the Institute of Chemical Engineers and a Fellow of the Institute of Directors. Dr. Wood has served as a director of Neenah since 2004. Dr. Wood's experience as the senior executive of global chemical manufacturing companies, his international and previous board experience, and his educational background make him an effective member of Neenah's Board. |

|

Age

74

Race/Ethnicity

White/Non-Hispanic Director Since

2004 Committees

Audit Committee Compensation Committee Public Directorship Experience

N/A Independent

Yes |

Neenah, Inc. 2021 Proxy Statement | 8

Table of Contents

ELECTION OF DIRECTORS (ITEM 1)

The Board unanimously recommends that the stockholders vote "FOR" the proposal to elect Timothy S. Lucas and Tony R. Thene as Class III directors for a three-year term expiring at the 2022 Annual Meeting of Stockholders and until their successors have been duly elected and qualified.

On January 30, 2019, the Board appointed Tony R. Thene to serve as a Class III director of the Company, effective as of February 1, 2019. As a result, the Board currently consists of nine members divided into one class of four directors (Class III), one class of three directors (Class I) and one class of two directors (Class II). Also on January 30, 2019, Sean T. Erwin and John F. McGovern delivered notice to the Board of their intent not to stand for re-election as Class III directors at the Company's 2019 Annual Meeting. The Board has not made any nominations and does not currently intend to fill these two Class III vacancies at this time. Accordingly, immediately following the 2019 Annual Meeting, the Board will consist of seven members divided into two classes of two directors (Classes II and III) and one class of three directors (Class I).

The directors in each class serve three-year terms, with the terms of the Class III directors expiring at the 2019 Annual Meeting. The Board has nominated Timothy S. Lucas and Tony R. Thene, each a current Class III director of Neenah, for re-election at the 2019 Annual Meeting. If re-elected, the nominees will serve a three-year term expiring at the 2022 Annual Meeting of Stockholders and until his successor has been duly elected and qualified. Each of the nominees has consented to serve another term as a director if re-elected. If any of the nominees should be unavailable to serve for any reason (which is not anticipated), the Board may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the election of such substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

If any incumbent nominee for director in an uncontested election should fail to receive the required affirmative vote of the holders of a majority of the shares represented and entitled to vote at the Annual Meeting, under Delaware law the director remains in office as a "holdover" director until his successor is elected and qualified or until his earlier resignation, retirement, disqualification, removal from office or death. In the event of a holdover director, the Board of Directors in its discretion may request the director to resign from the Board. If the director resigns, the Board of Directors may immediately fill the resulting vacancy, allow the vacancy to remain open until a suitable candidate is located and appointed, or adopt a resolution to decrease the authorized number of directors.

Set forth below is certain information as of March 29, 2019, regarding the nominees and each director continuing in office, including their ages, principal occupations (which have continued for at least the past five years unless otherwise noted), current Board experience and participation, and how the background, experience, and qualification of each nominee and director make them well suited to serve on Neenah's Board.

Information Regarding Class III Directors Nominated for Re-election

Timothy S. Lucas, born in 1946, was as an independent financial reporting consultant with Lucas Financial Reporting from 2002 until retiring in December 2017. From 1988 to 2002, Mr. Lucas worked at the Financial Accounting Standards Board ("FASB"), where he was the Director of Research and Technical Activities, and Chairman of the FASB's Emerging Issues Task Force. Mr. Lucas has served as a director of Neenah since 2004. Mr. Lucas received his BA in Economics and BS in Accounting from Rice University and his Master of Accounting from the Jesse H. Jones Graduate School, Rice University. Mr. Lucas' experience at FASB, consulting experience, and educational background make him an effective member of Neenah's Board.

Table of Contents

Tony R. Thene, born in 1960, currently serves as director and Chief Executive Officer of Carpenter Technology Corporation ("Carpenter"), a leader in specialty alloy-based materials and process solutions. Mr. Thene began his career at Carpenter in 2013 as Chief Financial Officer and has served as a director since 2015. Prior to 2013, Mr. Thene worked at Alcoa, Inc. in various senior financial and accounting leadership positions. Mr. Thene received his BS in Accounting from Indiana State University and his MBA from the Weatherhead School of Management at Case Western Reserve University. Mr. Thene has served as a director of Neenah since February 1, 2019. Mr. Thene's educational background, financial expertise, and extensive experience in the specialty materials industry make him an effective member of Neenah's Board.

Class I Directors—Term Expiring at the 2020 Annual Meeting

John P. O'Donnell, born in 1960, is President and Chief Executive Officer of Neenah and previously served as Chief Operating Officer from 2010 to 2011 and President, Fine Paper from 2007 to 2010. Prior to joining Neenah in 2007, Mr. O'Donnell was with Georgia Pacific Corporation since 1985 and held increasingly senior management positions in the Consumer Products division. Mr. O'Donnell served as President of the North American Retail Business from 2004 through 2007 and as President of the North American Commercial Tissue business from 2002 through 2004. Mr. O'Donnell received his BS from Iowa State University. Mr. O'Donnell has served as a director of Neenah since 2010. Mr. O'Donnell has also served as a director for Clearwater Paper since April 2016. Mr. O'Donnell's extensive experience in the paper and consumer products industries, and leadership positions in the Company make him an effective member of Neenah's Board.

William M. Cook, born in 1953, is the retired Executive Chairman (2015-2016) of Donaldson Company Inc. ("Donaldson"), a technology-driven global company that manufacturers filtration systems to remove contaminants from air and liquids. Mr. Cook is also the former Chairman (2005-2015), President and Chief Executive Officer (2004-2015) of Donaldson. Prior to that, Mr. Cook held various roles at Donaldson of increasing responsibility, including service as Senior Vice President, International (2000-2004); Chief Financial Officer (2001-2004); and Senior Vice President, Commercial and Industrial (1994-2000). Mr. Cook is also currently a Director of IDEX Corporation (where he serves as Lead Director and also on the Audit Committee) and was a director of Valspar Corporation (where he served on the Audit Committee) from 2010 to 2017. Mr. Cook brings to the Neenah Board his filtration industry and operations experience and financial expertise for the past 35 years at Donaldson where he held a wide range of financial and business positions with global responsibilities. Mr. Cook is an experienced public company Board member having served on the Donaldson Board from 2004-2016 and as an independent director for IDEX and Valspar. Mr. Cook also has valuable Board experience from his past service to various private and charitable organizations. Mr. Cook has served as a director of Neenah since 2016. Mr. Cook holds a BS degree in Business Management and an MBA degree from Virginia Tech. Mr. Cook's educational background, financial expertise, and extensive experience in the filtration industry make him an effective member of Neenah's Board.

Philip C. Moore, born in 1953, retired as Senior Vice President, Deputy General Counsel and Corporate Secretary of TD Bank Group, Toronto, Canada on December 31, 2016. Mr. Moore joined TD Bank Group in May 2013, prior to which he had been a partner at McCarthy Tétrault LLP, Canada's national law firm where he practiced corporate and securities law in Toronto and Sydney, Australia, with particular emphasis on corporate governance, finance, mergers and acquisitions, and other business law issues. He has been involved in many corporate mergers, acquisitions, dispositions, and reorganizations, as well as capital markets transactions in a variety of industries and geographies. Mr. Moore has extensive experience in corporate transactions involving the pulp and paper industries. Mr. Moore has been awarded the designation "Chartered Director" from the Directors College, Canada's leading director education program run by McMaster University and the Conference Board of Canada. He has advised on the design and implementation of numerous executive compensation plans,

Table of Contents

as well as on executive compensation governance matters. From 1994 until 2000, he was a director of Imax Corporation and is currently a director of a number of private corporations. Mr. Moore has served as a director of Neenah since 2004. Mr. Moore received his BA from McMaster University and his LLB from Queen's University. Mr. Moore's educational background and extensive experience in corporate governance and business law make him an effective member of Neenah's Board.

Class II Directors—Term Expiring at the 2021 Annual Meeting

Margaret S. Dano, born in 1959, is the former Chairman of the Board for Superior Industries International, Inc. ("Superior"), a leading manufacturer of aluminum road wheels for use in the automobile and light truck industry. Ms. Dano was appointed as Chairman of the Board in 2014 and served as a director for Superior from 2007 to 2017. In addition, Ms. Dano currently serves as a director of Douglas Dynamics, Inc., a manufacturer of snow and ice control equipment for the global light truck market, a position she has held since 2012, where she chairs the Governance committee and serves on both the compensation and audit committees. From 2002 to 2005, Ms. Dano served as Vice President, Worldwide Integrated Supply Chain and Operations for Honeywell Corporation. Prior to that she served as Vice President, Worldwide Supply Chain Office Products & GM Printer Papers for Avery Dennison Corporation from 1999 to 2002 and Vice President of Corporate Manufacturing & Engineering from 1996 to 1999. Ms. Dano received a BS in mechanical engineering from Kettering University (formerly the General Motors Institute). Ms. Dano has served as a director of Neenah since 2015. Ms. Dano's senior executive experience in global manufacturing and supply chain and her public board experience and leadership with manufacturing companies make her an effective member of Neenah's Board.

Stephen M. Wood, Ph.D., born in 1946, is an Operating Partner with Snow Phipps Group LLC, an internationally diversified investment company. Prior to this he served as Chairman of the Board for FiberVisions Corporation which is a leading global manufacturer of synthetic fibers for consumer products, construction, and industrial applications. Dr. Wood was President and Chief Executive Officer of FiberVisions from 2006 to 2012. Dr. Wood was also Chairman of the Board of ESFV, a global joint Venture with JNC Corporation, a leading Japanese Chemical Company. From 2001 to 2004, Dr. Wood served as President and Chief Executive Officer of Kraton Polymers, a specialties chemical company, and Chairman and Representative Director of JSR Kraton Elastomers, a Japanese joint venture company. Prior to this Dr. Wood was President of the Global Elastomers business of Shell Chemicals, Ltd., and a Vice President of that company. Dr. Wood was also elected International President of the International Institute of Synthetic Rubber Producers. Dr. Wood has a BSc in Chemistry and a Ph.D. in Chemical Engineering from Nottingham University, United Kingdom and is a graduate of the Institute of Chemical Engineers and a Fellow of the Institute of Directors. Dr. Wood has served as a director of Neenah since 2004. Dr. Wood's experience as the senior executive of global chemical manufacturing companies, his international and previous board experience, and his educational background make him an effective member of Neenah's Board.

Directors Retiring Effective as of the 2019 Annual Meeting

Sean T. Erwin, born in 1951, is the current Chairman of our Board. Mr. Erwin served as the Company's President and Chief Executive Officer from 2004 through May 2011. Prior to the spin-off of Neenah from Kimberly Clark Corporation on November 30, 2004, Mr. Erwin had been an employee of Kimberly Clark since 1978 and held increasingly senior positions in both finance and business management. In January 2004, Mr. Erwin was named President of Kimberly Clark's Pulp and Paper Sector, which comprised the businesses transferred to Neenah by Kimberly Clark in the spin-off. Mr. Erwin served as the President of the Global Nonwoven business from early 2001 and also served as the President of the European Consumer Tissue business, Managing Director of Kimberly Clark Australia, President of the Pulp and Paper Sector, and President of the Technical Paper business.

Table of Contents

Mr. Erwin received his BS in Accounting and Finance from Northern Illinois University. Mr. Erwin served as a director of Carmike Cinemas, Inc. from 2012-2016. Mr. Erwin has served as a director of Neenah since 2004. Mr. Erwin's extensive experience as former CEO of the Company and his vast industry experience and leadership positions make him an effective member of Neenah's Board.

John F. McGovern, born in 1946, is the founder, and since 1999 a partner, of Aurora Capital, LLC ("Aurora Capital"), a private investment and consulting firm based in Atlanta, Georgia. Prior to founding Aurora Capital, Mr. McGovern served in a number of positions of increasing responsibility at Georgia-Pacific Corporation from 1981 to 1999, including Executive Vice President/Chief Financial Officer from 1994 to 1999. Previously, Mr. McGovern had been Vice President and Director, Forest Products and Package Division of Chase Manhattan Bank. He currently serves as a director of Xerium Technologies, Inc. where he serves as audit committee chairman. Mr. McGovern also served as a director of GenTek, Inc. from 2003 to 2009, Maxim Crane Works Holdings, Inc. from 2005 to 2008, and Collective Brands, Inc. from 2003 to 2012. From 2006 to 2010, Mr. McGovern served as lead director of Neenah's Board for all executive sessions of non-management directors. Mr. McGovern has served as a director of Neenah since 2006. Mr. McGovern received his BS from Fordham University. Mr. McGovern's extensive experience as senior financial executive of a multinational paper products company and in the financial services industry, as well as his experience on other public company boards make him an effective member of Neenah's Board.

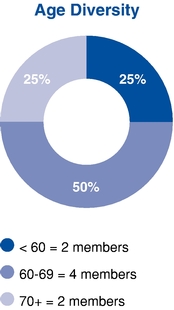

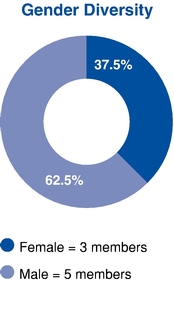

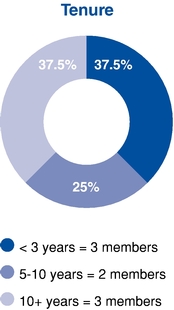

Director Skills Summary

Our Board of Directors possesses diverse experience and perspectives in various areas critical to our business. The Board's collective knowledge ensures appropriate management and risk oversight and supports our goal of creating long-term sustainable stockholder value.

| | | | | | | | | | | | | | |

Skills/Experience

| | O'Donnell | | Wood | | Dano | | Lucas | | Cook | | Moore | | Thene | | |

|---|

Our Board of Directors possesses diverse experience and perspectives in various areas critical to our business. The Board's collective knowledge ensures appropriate management and risk oversight and supports our goal of creating long-term sustainable stockholder value.

|

|

William M. Cook |

|

Donna M. Costello |

|

Margaret S. Dano |

|

Timothy S. Lucas |

|

Philip C. Moore |

|

Julie A. Schertell |

|

Tony R. Thene |

| | | | | | | | | | | | | | | | | |

| | Senior Executive/Strategic Leadership: experienceExperience in overseeing, developing, and/or implementing business strategy for a publicly listed company or other complex organization | | Xorganization. | | X· | | · | | X· | | · | | X· | | · | | X· |

| | | | | | | | | | | | | | | | | |

| | X | | X |

Manufacturing/Supply Chain: experienceExperience in manufacturing and/or supply chain management | | Xmanagement. | | X | | X· | | | | X· | | | | | | · | | X· |

| | | | | | | | | | | | | | | | |

| | International: experienceExperience in international business management or transactions | | Xtransactions. | | X· | | · | | X· | | | | X· | | · | | X· |

| | | | | | | | | | | | | | | | | |

| | X |

Capital/Asset Allocation: experienceExperience in assessing and/or implementing capital and/or asset allocation decisions | | Xdecisions. | | X· | | · | | X· | | | | X· | | · | | X· |

| | | | | | | | | | | | | | | | | |

| | X |

Talent Management & Executive Compensation: experienceExperience in human resources, leadership development, talent management, and/or executive compensation issues | | Xissues. | | X· | | | | X· | | · | | X· | | · | | X· |

| | | | | | | | | | | | | | | | | |

| | X | | X |

Audit/Accounting/Financial Statements: experienceExperience preparing, auditing, analyzing, or evaluating financial statements for a complex business | | Xbusiness. | | X· | | · | | X· | | · | | X· | | · | | X· |

| | | | | | | | | | | | | | | | | |

| | X | | X |

Capital Markets/Investor Relations: capitalCapital markets experience; experience relevant to institutional investor expectations | | Xexpectations. | | X· | | · | | X· | | | | X· | | · | | X· |

| | | | | | | | | | | | | | | | | |

| | X |

Legal/Regulatory/Risk Management: experienceExperience in the management or oversight of legal, compliance and regulatory affairs, and of risk management | | Xmanagement. | | X· | | · | | | | · | | · | | | | X· |

| | | | | | | | | | | | | | | | | |

| | X | | X | | X |

Other Board Experience: experienceExperience as a director of a publicly listed company or other complex organization | | Xorganization. | | X· | | · | | X· | | | | X· | | X | | X· |

Neenah, Inc. 2021 Proxy Statement | 9

Table of Contents

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

MEETINGS / COMMITTEES OF THE BOARD OF DIRECTORS |

The Board of Directors conducts its business through meetings of the full Board and through committees of the Board, consisting of an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, which we refer to as the Nominating Committee. The Board of Directors held sixfour regularly scheduled meetings and one specially-called meeting in 2018.2020. The directors also participated in additional ad hoc discussions on a variety of matters throughout the year. The Company's Corporate Governance Policies provide that all directors are expected to regularly attend and participate in Board and Committee meetings and encourage the directors to attend the Company's Annual Meeting. In 20182020, our directors attended 100% of the

regularly scheduled and specially scheduled meetings of the Board and of the committees of which he or she is a member. All of the Company's directors were in attendance at the 20182020 Annual Meeting. The 2020 Annual Meeting and all Board and committee meetings held after March 15, 2020 were held via video conference due to safety concerns relating to the COVID-19 pandemic.

Neenah holds regularly scheduled executive sessions of the independent directors at each Board meeting. As Chairman of the Board, Mr. ErwinCook presides at all the executive sessions other than meetings of the non-affiliated independent directors, at which Mr. McGovern presides. Following the 2019 Annual Meeting, Mr. Cook will preside at all the executive sessions.

The following table describes the current membership of each of the committees:

| | | | | | |

| | Audit Committee | | Nominating and Corporate

Governance Committee | | Compensation Committee |

|---|

Timothy S. Lucas | | Chair(1) | | | | X |

John F. McGovern | | | | Chair(2) | | X(2) |

Stephen M. Wood | | X | | | | Chair |

Margaret S. Dano | | | | X | | X |

William M. Cook | | X(1) | | X | | |

Philip C. Moore | | X | | X | | |

Tony R. Thene | | | | | | |

Number of meetings | | 8 | | 4 | | 5 |

(1)The Board has determined that Mr. Lucas and Mr. Cook are audit committee financial experts within the meaning of the SEC's rules.

(2)Mr. McGovern is not standing for re-election as a Class III director at the 2019 Annual Meeting. Mr. McGovern will be succeeded as Chairman of the Nominating and Corporate Governance Committee by Ms. Dano.

| | |

| AUDIT COMMITTEE | | |

The Audit Committee is comprised solely of directors who meet the independence requirements of the New York Stock Exchange ("NYSE") and the Securities Exchange Act of 1934, as amended ("Exchange Act"), and are financially literate, as required by NYSE rules. At least one member of the Audit Committee is an audit committee financial expert, as defined by the rules and regulations of the Securities and Exchange Commission ("SEC"). The Audit Committee has been established in accordance with applicable rules promulgated by the NYSE and the SEC. The Audit Committee assists the Board in monitoring: • the quality and integrity of our financial statements; • our compliance with ethical policies contained in our Code of Business Conduct and Ethics, and legal and regulatory requirements; • the independence, qualification and performance of our registered public accounting firm; • the performance of our internal auditors; • related party transactions; and • policies with respect to risk assessment and risk management, including, data privacy and data security risks. The Audit Committee is governed by the Audit Committee Charter approved by the Board. The charter is available on our website at www.neenah.com. | | COMMITTEE AND MEMBERS

Timothy S. Lucas, Chair

Stephen M. Wood

William M. Cook

Philip C. Moore

Donna M. Costello

Number of Meetings

9

› All members are independent › All members are financially literate under NYSE standards › The Board has determined that Messrs. Lucas and Cook and Ms. Costello are audit committee financial experts within the meaning of the SEC's rules. |

| | | |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

|

|

The Nominating Committee is comprised solely of directors who meet the NYSE independence requirements. The Nominating Committee: • oversees the process by which individuals are nominated to our Board; • reviews the qualifications, performance, and independence of members of our Board; • reviews and recommends policies with respect to composition, organization, processes and, practices of our Board, including diversity; and • identifies and investigates emerging corporate governance issues and advises the Board on oversight responsibilities relating to the Company's ethical conduct, corporate culture, and employee health and safety. The Nominating Committee is governed by the Nominating and Corporate Governance Committee Charter approved by the Board. The charter is available on our website at www.neenah.com. | | COMMITTEE AND MEMBERS Margaret S. Dano, Chair

Philip C. Moore

Tony R. Thene

Number of Meetings

4 › All members are independent |

Audit CommitteeNeenah, Inc. 2021 Proxy Statement | 10

The Audit Committee is comprised solely of directors who meet the independence requirements of the New York Stock Exchange ("NYSE") and the Securities Exchange Act of 1934, as amended ("Exchange Act"), and are financially literate, as required by NYSE rules. At least one member of the Audit Committee is an audit committee financial expert, as defined by the rules and regulations of the SEC. The Audit Committee has been established in accordance with applicable rules promulgated by the NYSE and the SEC. The Audit Committee assists the Board in monitoring:

•the quality and integrity of our financial statements;

•our compliance with ethical policies contained in our Code of Business Conduct and Ethics, and legal and regulatory requirements;

•the independence, qualification and performance of our registered public accounting firm;

•the performance of our internal auditors; and

•related party transactions.

Table of Contents

| | |

| COMPENSATION COMMITTEE | | |

The Compensation Committee is comprised solely of directors who meet NYSE independence requirements, meet the requirements for a "non-employee director" under the Exchange Act, meet the requirements of Rule 10C-1 under the Exchange Act, and meet the requirements for an "outside director" under Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"). The Compensation Committee: • reviews and approves corporate goals and objectives relevant to the compensation of our Chief Executive Officer and sets such compensation; • approves, in consultation with our Chief Executive Officer, the compensation of our officers who are elected by our Board; • makes recommendations to our Board with respect to our equity-based plans and executive incentive compensation plans; and • reviews with management and approves awards under our long-term incentive compensation plans and equity-based plans. The Compensation Committee is governed by the Compensation Committee Charter approved by the Board. The charter is available on our website at www.neenah.com. Additional information regarding the Compensation Committee's processes and procedures for consideration of executive compensation is provided in the "Compensation Discussion and Analysis" below. | | COMMITTEE AND MEMBERS Stephen M. Wood, Chair

Timothy S. Lucas

Margaret S. Dano

Tony R. Thene Number of Meetings

5 › All members are independent |

The Audit Committee is governed by the Audit Committee Charter approved by the Board. The charter is available on our website atNeenah, Inc.www.neenah.com 2021 Proxy Statement .| 11

Nominating and Corporate Governance Committee

The Nominating Committee is comprised solely of directors who meet the NYSE independence requirements. The Nominating Committee:

•oversees the process by which individuals are nominated to our Board;

•reviews the qualifications, performance and independence of members of our Board;

•reviews and recommends policies with respect to composition, organization, processes and practices of our Board, including diversity; and

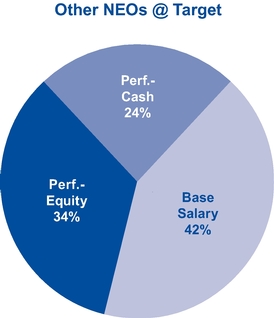

•identifies and investigates emerging corporate governance issues and trends that may affect us.